Seedvest is a digital asset investing company that enables investors of all wealth levels the ability to invest in digital assets through a user-friendly platform that offers a diverse range of investment opportunities. Investors can now access a professionally-managed, tax-advantaged, secure, transparent and efficient portfolio of digital assets market allowing individuals to participate in the growing world of crypto currencies, digital real estate and forex, tokenized assets, and blockchain-based ventures. Whether you're a seasoned investor or a beginner, Seedvest democratizes access to the digital economy. Investors can start earning passive income today.

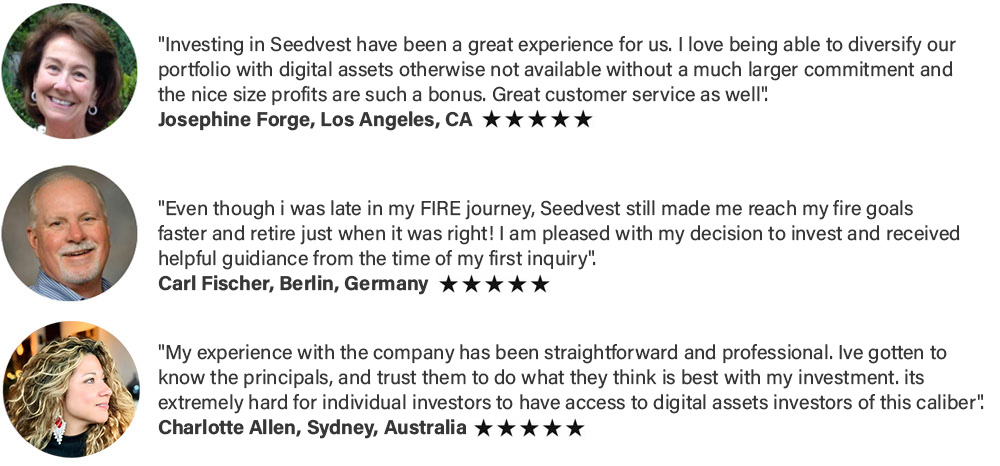

Private digital assets investment can be a trusted source of passive income and capital protection. Historically, private digital assets investments have only been accessible to ultra high net worth individuals and large institutional investors. Now with Seedvest, anyone can benefits from investing in institutional-quality digital asset investing.

During periods of moderate and high inflation, digital assets have consistently outperformed the stock market. On average, digital assets outperformed the S&P 500 by 3.5% during these periods. In periods of moderate inflation, digital asset profits more than compensated for the higher price returns on the S&P, leading total returns on digital assets to exceed the S&P 500 by 2.4%.